Page 20 - Budget FY 2022-2023 - Update

P. 20

City of McAllen, Texas Adopted Budget 2023

Current Property Tax

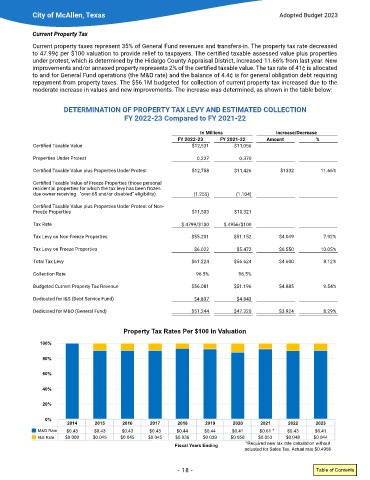

Current property taxes represent 35% of General Fund revenues and transfers-in� The property tax rate decreased

to 47.99¢ per $100 valuation to provide relief to taxpayers. The certified taxable assessed value plus properties

under protest, which is determined by the Hidalgo County Appraisal District, increased 11�66% from last year� New

improvements and/or annexed property represents 2% of the certified taxable value. The tax rate of 41¢ is allocated

to and for General Fund operations (the M&O rate) and the balance of 4�4¢ is for general obligation debt requiring

repayment from property taxes� The $56�1M budgeted for collection of current property tax increased due to the

moderate increase in values and new improvements� The increase was determined, as shown in the table below:

DETERMINATION OF PROPERTY TAX LEVY AND ESTIMATED COLLECTION

FY 2022-23 Compared to FY 2021-22

In Millions Increase/Decrease

FY 2022-23 FY 2021-22 Amount %

Certified Taxable Value $12,531 $11,056

Properties Under Protest 0�227 0�370

Certified Taxable Value plus Properties Under Protest $12,758 $11,426 $1332 11�66%

Certified Taxable Value of Freeze Properties (those personal

residential properties for which the tax levy has been frozen

due owner receiving “over-65 and/or disabled” eligibility) (1�255) (1�104)

Certified Taxable Value plus Properties Under Protest of Non-

Freeze Properties $11,503 $10,321

Tax Rate $�4799/$100 $�4956/$100

Tax Levy on Non-Freeze Properties $55�201 $51�152 $4�049 7�92%

Tax Levy on Freeze Properties $6�022 $5�472 $0�550 10�05%

Total Tax Levy $61�224 $56�624 $4�600 8�12%

Collection Rate 96�5% 96�5%

Budgeted Current Property Tax Revenue $56�081 $51�196 $4�885 9�54%

Dedicated for I&S (Debt Service Fund) $4�837 $4�843

Dedicated for M&O (General Fund) $51�244 $47�320 $3�924 8�29%

Property Tax Rates Per $100 in Valuation

100%

80%

60%

40%

20%

0%

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

$0.43

$0.43

$0.41

$0.61

$0.61

$0.44

$0.41

$0.44

M&O Rate $0.43 $0.43 $0.43 $0.43 $0.44 $0.44 $0.41 $0.61 * $0.43 $0.41

$0.41

$0.41

$0.44

$0.43

$0.43

$0.44

$0.43

$0.43

$0.43

$0.43

$0.43

$0.43

$0.056

$0.048

$0.044

$0.044

$0.053

$0.053

$0.048

$0.056

$0.045

$0.045

$0.045

$0.045

$0.000

$0.000

$0.045

$0.045

$0.039

$0.039

$0.036

$0.036

I&S Rate $0.000 $0.045 $0.045 $0.045 $0.036 $0.039 $0.056 $0.053 $0.048 $0.044

Fiscal Years Ending *Required new tax rate calculation without

adjusted for Sales Tax. Actual rate $0.4956

- 18 - Table of Contents