Page 20 - APPROVED ANNUAL BUDGET BOOK FY 21-22

P. 20

City of McAllen, Texas Adopted Budget 2022

Current Property Tax

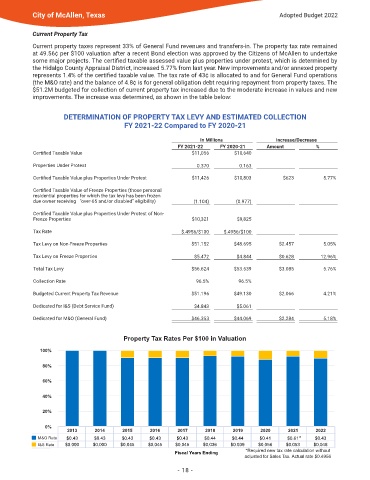

Current property taxes represent 33% of General Fund revenues and transfers-in� The property tax rate remained

at 49�56¢ per $100 valuation after a recent Bond election was approved by the Citizens of McAllen to undertake

some major projects. The certified taxable assessed value plus properties under protest, which is determined by

the Hidalgo County Appraisal District, increased 5�77% from last year� New improvements and/or annexed property

represents 1.4% of the certified taxable value. The tax rate of 43¢ is allocated to and for General Fund operations

(the M&O rate) and the balance of 4�8¢ is for general obligation debt requiring repayment from property taxes� The

$51�2M budgeted for collection of current property tax increased due to the moderate increase in values and new

improvements� The increase was determined, as shown in the table below:

DETERMINATION OF PROPERTY TAX LEVY AND ESTIMATED COLLECTION

FY 2021-22 Compared to FY 2020-21

In Millions Increase/Decrease

FY 2021-22 FY 2020-21 Amount %

Certified Taxable Value $11,056 $10,640

Properties Under Protest 0�370 0�163

Certified Taxable Value plus Properties Under Protest $11,426 $10,803 $623 5�77%

Certified Taxable Value of Freeze Properties (those personal

residential properties for which the tax levy has been frozen

due owner receiving “over-65 and/or disabled” eligibility) (1�104) (0�977)

Certified Taxable Value plus Properties Under Protest of Non-

Freeze Properties $10,321 $9,825

Tax Rate $�4956/$100 $�4956/$100

Tax Levy on Non-Freeze Properties $51�152 $48�695 $2�457 5�05%

Tax Levy on Freeze Properties $5�472 $4�844 $0�628 12�96%

Total Tax Levy $56�624 $53�539 $3�085 5�76%

Collection Rate 96�5% 96�5%

Budgeted Current Property Tax Revenue $51�196 $49�130 $2�066 4�21%

Dedicated for I&S (Debt Service Fund) $4�843 $5�061

Dedicated for M&O (General Fund) $46�353 $44�069 $2�284 5�18%

Property Tax Rates Per $100 in Valuation

100%

80%

60%

40%

20%

0%

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

$0.44

$0.43

$0.43

$0.41

M&O Rate $0.43 $0.43 $0.43 $0.43 $0.43 $0.44 $0.44 $0.41 $0.61* $0.43

$0.43

$0.44

$0.44

$0.44

$0.43

$0.43

$0.43

$0.61

$0.43

$0.43

$0.61

$0.43

$0.43

$0.41

$0.43

$0.43

$0.048

$0.039

$0.056

$0.053

$0.048

$0.056

$0.053

$0.039

$0.045

$0.045

$0.000

$0.000

$0.000

$0.000

$0.045

$0.036

$0.036

$0.045

$0.045

$0.045

I&S Rate $0.000 $0.000 $0.045 $0.045 $0.045 $0.036 $0.039 $0.056 $0.053 $0.048

Fiscal Years Ending *Required new tax rate calculation without

adjusted for Sales Tax. Actual rate $0.4956

- 18 -