Page 211 - Budget FY 2022-2023 - Update

P. 211

Adopted Budget 2023 City of McAllen, Texas

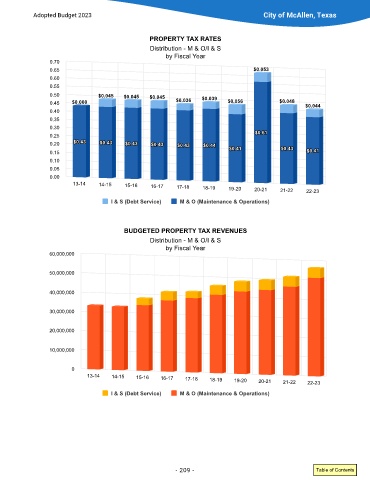

PROPERTY TAX RATES

Distribution - M & O/I & S

by Fiscal Year

0.70

$0.053

$0.053

0.65 $0.053

0.60

0.55

0.50 $0.045 $0.045 $0.045 $0.039

$0.045

$0.045

$0.045

$0.045

$0.045

$0.045

$0.039

$0.039

$0.036

$0.036

$0.056

$0.056

$0.048

$0.048

$0.000

$0.000

0.45 $0.000 $0.036 $0.056 $0.048 $0.044

$0.044

$0.044

0.40

0.35

0.30

$0.61

$0.61

0.25 $0.61

$0.43

$0.43

$0.43

$0.43

$0.43

$0.43

$0.43

$0.43

0.20 $0.43 $0.43 $0.43 $0.43 $0.43 $0.44 $0.41 $0.43

$0.43

$0.44

$0.44

$0.43

$0.41

$0.41

$0.43

$0.43

$0.41

$0.41

0.15 $0.41

0.10

0.05

0.00

13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22 22-23

I & S (Debt Service) M & O (Maintenance & Operations)

BUDGETED PROPERTY TAX REVENUES

Distribution - M & O/I & S

by Fiscal Year

60,000,000

50,000,000

40,000,000

30,000,000

20,000,000

10,000,000

0

13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22 22-23

I & S (Debt Service) M & O (Maintenance & Operations)

- 209 - Table of Contents