Page 22 - ANALYSIS.XLS

P. 22

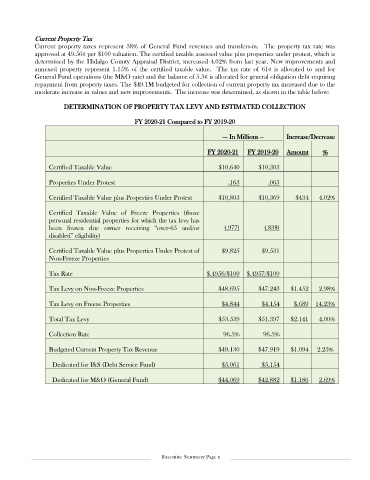

Current Property Tax

Current property taxes represent 38% of General Fund revenues and transfers-in. The property tax rate was

approved at 49.56¢ per $100 valuation. The certified taxable assessed value plus properties under protest, which is

determined by the Hidalgo County Appraisal District, increased 4.02% from last year. New improvements and

annexed property represent 1.15% of the certified taxable value. The tax rate of 61¢ is allocated to and for

General Fund operations (the M&O rate) and the balance of 5.3¢ is allocated for general obligation debt requiring

repayment from property taxes. The $49.1M budgeted for collection of current property tax increased due to the

moderate increase in values and new improvements. The increase was determined, as shown in the table below:

DETERMINATION OF PROPERTY TAX LEVY AND ESTIMATED COLLECTION

FY 2020-21 Compared to FY 2019-20

--- In Millions -- Increase/Decrease

FY 2020-21 FY 2019-20 Amount %

Certified Taxable Value $10,640 $10,303

Properties Under Protest .163 .065

Certified Taxable Value plus Properties Under Protest $10,803 $10,369 $434 4.02%

Certified Taxable Value of Freeze Properties (those

personal residential properties for which the tax levy has

been frozen due owner receiving “over-65 and/or (.977) (.838)

disabled” eligibility)

Certified Taxable Value plus Properties Under Protest of $9,825 $9,531

Non-Freeze Properties

Tax Rate $.4956/$100 $.4957/$100

Tax Levy on Non-Freeze Properties $48.695 $47.243 $1.452 2.98%

Tax Levy on Freeze Properties $4.844 $4.154 $.689 14.23%

Total Tax Levy $53.539 $51.397 $2.141 4.00%

Collection Rate 96.5% 96.5%

Budgeted Current Property Tax Revenue $49.130 $47.919 $1.094 2.23%

Dedicated for I&S (Debt Service Fund) $5.061 $5.154

Dedicated for M&O (General Fund) $44.069 $42.882 $1.186 2.69%

Executive Summary Page x