Page 127 - City of McAllen - Approved Annual Budget Book FY 24-25

P. 127

Adopted Budget 2025 City of McAllen, Texas

General Fund

Tax Office

www�mcallen�net/departments/tax

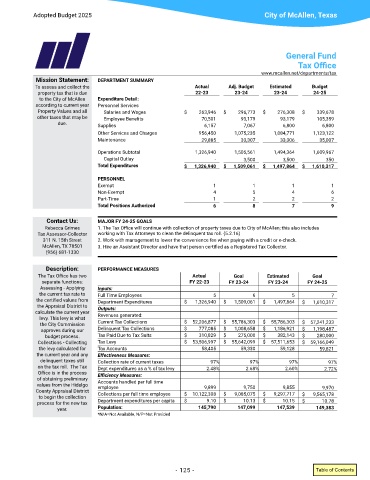

Mission Statement: DEPARTMENT SUMMARY

To assess and collect the Actual Adj. Budget Estimated Budget

property tax that is due 22-23 23-24 23-24 24-25

to the City of McAllen Expenditure Detail:

according to current year Personnel Services

Property Values and all Salaries and Wages $ 263,946 $ 296,773 $ 276,308 $ 339,678

other taxes that may be Employee Benefits 70,501 93,179 93,179 105,359

due� Supplies 6,157 7,067 6,800 6,800

Other Services and Charges 956,450 1,075,235 1,084,771 1,123,122

Maintenance 29,885 33,307 33,306 35,007

Operations Subtotal 1,326,940 1,505,561 1,494,364 1,609,967

Capital Outlay - 3,500 3,500 350

Total Expenditures $ 1,326,940 $ 1,509,061 $ 1,497,864 $ 1,610,317

PERSONNEL

Exempt 1 1 1 1

Non-Exempt 4 5 4 6

Part-Time 1 2 2 2

Total Positions Authorized 6 8 7 9

Contact Us: MAJOR FY 24-25 GOALS

Rebecca Grimes 1. The Tax Office will continue with collection of property taxes due to City of McAllen; this also includes

Tax Assessor-Collector working with Tax Attorneys to clean the delinquent tax roll� (5�2�16)

311 N. 15th Street 2� Work with management to lower the convenience fee when paying with a credit or e-check�

McAllen, TX 78501 3. Hire an Assistant Director and have that person certified as a Registered Tax Collector.

(956) 681-1330

Description: PERFORMANCE MEASURES

The Tax Office has two Actual Goal Estimated Goal

separate functions: FY 22-23 FY 23-24 FY 23-24 FY 24-25

Assessing - Applying Inputs:

the current tax rate to Full Time Employees 5 6 5 7

the certified values from Department Expenditures $ 1,326,940 $ 1,509,061 $ 1,497,864 $ 1,610,317

the Appraisal District to Outputs:

calculate the current year Revenues generated:

levy� This levy is what

the City Commission Current Tax Collections $ 52,206,877 $ 55,786,303 $ 55,786,303 $ 57,241,233

approves during our Delinquent Tax Collections $ 777,085 $ 1,008,658 $ 1,186,921 $ 1,198,487

budget process� Tax Paid Due to Tax Suits $ 310,829 $ 275,000 $ 382,143 $ 280,000

Collections - Collecting Tax Levy $ 53,506,997 $ 55,642,099 $ 57,511,653 $ 59,166,049

the levy calculated for Tax Accounts 58,405 59,330 59,128 59,821

the current year and any Effectiveness Measures:

delinquent taxes still Collection rate of current taxes 97% 97% 97% 97%

on the tax roll� The Tax Dept expenditures as a % of tax levy 2�48% 2�68% 2�60% 2�72%

Office is in the process Efficiency Measures:

of obtaining preliminary Accounts handled per full time

values from the Hidalgo employee 9,899 9,750 9,855

County Appraisal District Collections per full time employee 9,085,075 $ 9,970

$ 10,122,308 $

to begin the collection 9,297,717 $ 9,565,178

process for the new tax Department expenditures per capita $ 9�10 $ 10�13 $ 10�15 $ 10�78

year� Population: 145,790 147,099 147,539 149,383

*N/A=Not Available, N/P=Not Provided

- 125 - Table of Contents