Page 120 - Budget FY 2022-2023 - Update

P. 120

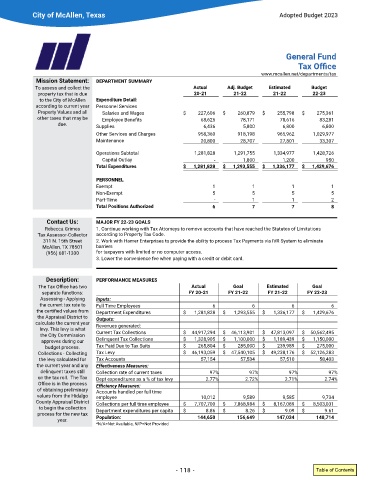

City of McAllen, Texas Adopted Budget 2023

General Fund

Tax Office

www�mcallen�net/departments/tax

Mission Statement: DEPARTMENT SUMMARY

To assess and collect the Actual Adj. Budget Estimated Budget

property tax that is due 20-21 21-22 21-22 22-23

to the City of McAllen Expenditure Detail:

according to current year Personnel Services

Property Values and all Salaries and Wages $ 227,606 $ 260,879 $ 255,798 $ 275,361

other taxes that may be Employee Benefits 68,625 78,171 78,616 83,281

due� Supplies 6,436 5,800 6,800 6,800

Other Services and Charges 958,360 918,198 965,962 1,029,977

Maintenance 20,800 28,707 27,801 33,307

Operations Subtotal 1,281,828 1,291,755 1,334,977 1,428,726

Capital Outlay - 1,800 1,200 950

Total Expenditures $ 1,281,828 $ 1,293,555 $ 1,336,177 $ 1,429,676

PERSONNEL

Exempt 1 1 1 1

Non-Exempt 5 5 5 5

Part-Time - 1 1 2

Total Positions Authorized 6 7 7 8

Contact Us: MAJOR FY 22-23 GOALS

Rebecca Grimes 1� Continue working with Tax Attorneys to remove accounts that have reached the Statutes of Limitations

Tax Assessor-Collector according to Property Tax Code�

311 N� 15th Street 2� Work with Hamer Enterprises to provide the ability to process Tax Payments via IVR System to eliminate

McAllen, TX 78501 barriers

(956) 681-1330 for taxpayers with limited or no computer access�

3� Lower the convenience fee when paying with a credit or debit card�

Description: PERFORMANCE MEASURES

The Tax Office has two Actual Goal Estimated Goal

separate functions: FY 20-21 FY 21-22 FY 21-22 FY 22-23

Assessing - Applying Inputs:

the current tax rate to Full Time Employees 6 6 6 6

the certified values from Department Expenditures $ 1,281,828 $ 1,293,555 $ 1,336,177 $ 1,429,676

the Appraisal District to Outputs:

calculate the current year Revenues generated:

levy� This levy is what

the City Commission Current Tax Collections $ 44,917,294 $ 46,113,901 $ 47,813,097 $ 50,562,495

approves during our Delinquent Tax Collections $ 1,328,905 $ 1,100,000 $ 1,189,439 $ 1,150,000

budget process� Tax Paid Due to Tax Suits $ 265,804 $ 285,000 $ 239,989 $ 275,000

Collections - Collecting Tax Levy $ 46,193,059 $ 47,540,105 $ 49,238,176 $ 52,126,283

the levy calculated for Tax Accounts 57,154 57,534 57,510 58,403

the current year and any Effectiveness Measures:

delinquent taxes still Collection rate of current taxes 97% 97% 97% 97%

on the tax roll� The Tax Dept expenditures as a % of tax levy 2�77% 2�72% 2�71% 2�74%

Office is in the process Efficiency Measures:

of obtaining preliminary Accounts handled per full time

values from the Hidalgo employee 10,012 9,589 9,585 9,734

County Appraisal District Collections per full time employee $ 7,707,700 $ 7,868,984 $ 8,167,089 $ 8,503,031

to begin the collection

process for the new tax Department expenditures per capita $ 8�86 $ 8�26 $ 9�09 $ 9�61

year� Population: 144,650 156,649 147,034 148,714

*N/A=Not Available, N/P=Not Provided

- 118 - Table of Contents